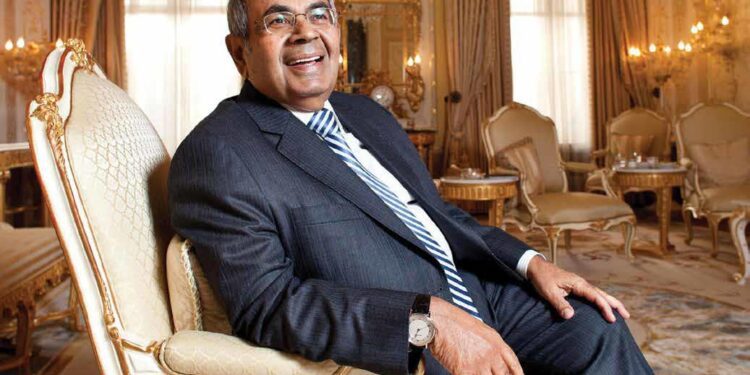

![]() I travelled all around the world looking for a home but when I finally came to London, I decided this is the best city in the world to live in,” says Gopichand Hinduja, Londonbased Co-chairman of the Hinduja Group.

I travelled all around the world looking for a home but when I finally came to London, I decided this is the best city in the world to live in,” says Gopichand Hinduja, Londonbased Co-chairman of the Hinduja Group.

He attributes the success of the British economy to the spirit of UK’s immigrant community. Britain would not be the fastest growing economy among G7 countries without its immigrant communities. Exhorting Asians to act as a bridge between their adopted country and home country to meet the goal of increasing trade, Hinduja says the key to success is to seek a good local partner. “Our Group can help across countries, especially Asia where we enjoy 72-74 per cent market share,” he says. Asia is already well on its way to becoming the world’s largest producer of goods and services, it will also be the world’s largest consumer of them.

Prized possessions

The Hinduja brothers — Srichand, Gopichand, Prakash and Ashok – stunned the world in 2006 with the 13-16 Carlton House Terrace acquisition. A heritage structure, it was built in 1831, spread over 67,000 square feet in the City of Westminster, neighbouring Buckingham Palace.

The family bought the property for £58 million from the Crown Estate and spent another £50 million in renovations before they could call it home in 2011.

Their next astonishing purchase was Britain’s Old War Office (OWO) at Whitehall, for £1.2 billion in 2014. Known for its classic Edwardian baroque interiors, the OWO has since been renovated for over five years, in keeping with the rich legacy and the historical architectural elements of the building, for £1.2 billion. The brothers are acquiring historic and heritage properties in London, a game of Monopoly, buying not where the die rolls but where the eye goes.

Now repurposed into a luxury hotel called Raffles London at The OWO, it is all set to open in the spring of 2023. “The OWO is my greatest legacy to London for future generations to enjoy,” says Gopichand Hinduja. Not only is The OWO the Hinduja Group’s first foray into hospitality business, it is also the first Raffles hotel and the first Guerlain Spa in London, exclusive to the Raffles London at The OWO too.

Classic beauty

British architect William Young designed the building originally and the project was completed in 1906. The OWO is a Grade II listed building, which has witnessed innumerable world-shaping events – its 1,100 rooms and four kilometres of corridors, were used by Winston Churchill during World War II, leading Britain to wartime victory; Bond movie lovers will remember snapshots of this location in “Skyfall”, “Spectre”, “License to Kill”, “A View to a Kill”, “Octopussy” and “No Time To Die”.

In its new avatar, the 120 rooms and suites, including a Winston Churchill Suite, have been designed by French architect and interior designer, Thierry Despont, known for the restoration of the Statue of Liberty in New York as an associate architect in the ’80s, and transforming landmark buildings like The Getty Centre and Maison Cartier.

The 85 branded residences, a first for Raffles in Europe, complete with a heady mix of history, mystery and royal glamour, make them the most expensive in London. They are priced upwards of £7.1million for a two-bedroom residence, £10million for a two-bedroom residence designed by Albion Nord and £14.25million for a threebedroom residence designed by Angel O’Donnell. Both are prominent Londonbased interior design studios.

A home to kill for

A four-bedroom residence on the fifth floor is an ode to the espionage history of the building. It is accessed through the Spies Entrance, a door used by MI6 staff after covert missions, and the name has been retained from 1909 when the British Secret Service Bureau was established as a department of the War Office. It still makes for discreet arrivals and departures.

Philippe Leboeuf, Managing Director at Raffles London at The OWO, confirms the hotel’s opening, as he says, “This staggering piece of British history will be open to the public for the very first time from Spring 2023, thanks to the Hindujas’ tireless work in sensitively conserving this significant address, partnering with experts including English Heritage, MOLA (Museum of London Archaeology) and EPR Architects.” The acclaimed Italian-Argentine Chef Mauro Colagreco of Mirazur, a modernist cuisine restaurant, which he opened in 2006 in Menton, France, will recreate unique dining experiences set within The OWO’s most storied rooms.

Of the nine restaurants and bars at The OWO, Paper Moon, a family-run Italian restaurant founded by Pio Galligani and his wife Enrica Del Rosso in Milan, in 1977, will be the first independent one here. This hospitality venture is the first of its kind in scale, spend and historical relevance, with an Indian business family restoring the history of a British landmark. It remains to be seen if the billions that The OWO has been bought, acquired and repurposed for, tempts the Hinduja family enough to make hospitality another key business for their group.

Masters from the University of Life

Gopichand Hinduja, fondly known as ‘GP’ in business circles, prefers to call himself the student of the University of Life and believes experience has been his best teacher. A graduate from Mumbai University, GP joined the family business at a young age of 19 years.

Despite no formal management education, GP along with his elder brother SP transformed their family business from an Indo-Middle East trading group into a multi-billion dollar transnational conglomerate.

From the very first acquisition of globally renowned iconic brand, Gulf Oil, in 1984, or in 1987, making the first major NRI investment into India with the acquisition of Ashok Leyland, the then struggling Indian automotive manufacturer, or later to acquisitions of the UK’s electric bus manufacturer, Optare which he has overseen and guided to be transformed into Switch Mobility, the leading EV foray of Ashok Leyland.

He was also instrumental, first in acquisition of Houghton Inc. in USA by the Group, and later in its merger with Quaker Inc to become QuakerHoughton, an NYSE listed global leader in metal working fluids, of which the Group is the single largest shareholder.

GP remains at the forefront of the Group’s global M&A activities. Irrespective of any of the business sectors that the Group may be invested in, GP prefers to have a direct, hands-on approach towards any M&A opportunity that Group keeps exploring. GP has had the honour of receiving numerous awards, including the Lifetime Achievement Award.