THE VISION: To be an integrated financial and support services provider par excellence, benchmarked with global best practices and standards, for the bottom of the pyramid universe for their comprehensive economic and social development

THE VISION: To be an integrated financial and support services provider par excellence, benchmarked with global best practices and standards, for the bottom of the pyramid universe for their comprehensive economic and social development

THE MISSION: To create an inclusive, sustainable and value based entrepreneurial culture, in collaboration with our partner institutions in achieving economic success and financial security

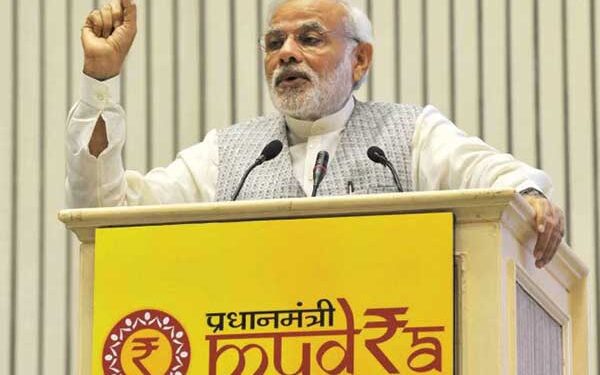

With these lofty objectives, the Pradhan Mantri MUDRA Yojana (PMMY) was launched on April 8, 2015 by Prime Minister Narendra Modi to facilitate easy collateral-free microcredit of up to Rs 10 lakh to non-corporate, non-farm small and micro-entrepreneurs for income-generating activities “Our basic purpose is to attain development in an inclusive and sustainable manner by supporting and promoting partner institutions and creating an ecosystem of growth for micro enterprises sector,” PM Modi said at the launch.

In eight years since its launch, banks and financial institutions have already sanctioned Rs 23.2 lakh crore to over 40.82 crore beneficiaries.

MUDRA, or Micro Units Development and Refinance Agency, is a refinancing Institution. It does not lend directly to the micro entrepreneurs/individuals. Loans under the PMMY can be availed of from banks, NBFCs and MFIs etc.

68 pc women beneficiaries

Speaking on the occasion of the 8th anniversary of MUDRA, Finance Minister Nirmala Sitharaman said, since the launch of the PMMY, about Rs 23.2 lakh crore had been sanctioned in 40.82 crore loan accounts. About 68 per cent of the accounts under the scheme belong to women entrepreneurs and 51 per cent belong to entrepreneurs of SC/ST and OBC categories. This demonstrates that easy availability of credit to the budding entrepreneurs of the country has led to innovation and sustained increase in per capita income, she said.

Highlighting indigenous growth through the MSMEs, the Finance Minister underlined that the growth of MSMEs had contributed massively to the ‘Make in India’ programme, as strong domestic MSMEs lead to increased indigenous production both for domestic markets as well as for exports. “The PMMY scheme has helped in the generation of largescale employment opportunities at the grassroots level, and also has proved to be a game changer while boosting the Indian economy,” she said.

Un-served, under-served

On the occasion, Union Minister of State (MoS) for Finance Bhagwat Kisanrao Karad said, “The PMMY scheme aims to provide collateral-free access to credit in a seamless manner to micro enterprises in the country. It has brought the unserved and under-served sections of the society within the framework of institutional credit.”

He said the Government policy of promoting MUDRA led millions of MSME enterprises in the formal economy and helped them to get out of the clutches of moneylenders offering very high cost funds.

Loans under the PMMY are provided by Member Lending Institutions (MLIs) — banks, non-banking financial companies (NBFCs), microfinance institutions (MFIs) and other financial intermediaries, the Finance Ministry said in a statement.

Contrast to pre-2014

India after eight years of PMMY provides a stark contrast to the grim situation that existed in the credit market before PM Modi formed the Government in 2014.

One can glance back at the changes wrought by this mass credit saturation programme that was envisaged during the bleak days of 2014-15 when the formal financial sector was reeling under bad loans, especially its impact on the sociocultural fabric of the country.

The implementation of the financial inclusion programme in the country is based on three pillars – Banking the Unbanked, Securing the Unsecured and Funding the Unfunded.

Collateral-free loans

The scheme was launched to encourage small businesses, and banks were asked to provide collateral-free loans up to Rs 10 lakh under three categories – Shishu (up to Rs 50,000), Kishore (between Rs 50,000 and Rs 5 lakh) and Tarun (Rs 10 lakh).

Of the three, Shishu accounts for 83 per cent of the total loans while Kishore 15 per cent and the remaining 2 per cent Tarun.

Targets have been achieved since the inception of the scheme barring during 2020-21 due to the Covid-19 pandemic, an official statement from the Union Finance Ministry said.

In less than a decade this mass credit saturation programme has brought about a sea change for India’s unreached millions of marginalised people, impacting the sociocultural fabric of the country.